📊 Real Estate Investment Proforma

Property: 1375 Bryant Street NE, Washington, D.C. 20018

Type: 4-Unit Multifamily (RA-1 zoning)

Prepared by: Ken Bossard, MBA

1. Property Summary

- Year Built: 1941

- Current Condition: Vacant, boarded, with green D.C. vacant sticker. Current on taxes.

- Square Footage: 3,140 SF (4 units, 1BR/1BA each; redevelopment potential to 2BR/1BA each).

- Zoning: RA-1 (low- to moderate-density apartments; potential for mixed-use with conditional approvals).

- Neighborhood: Brookland/Rhode Island Metro submarket – strong rental demand, moderate condo absorption.

2. Comparable Market Analysis

| Property | Units | Sq. Ft. | Status | Price | PPSF |

|---|---|---|---|---|---|

| B59 | 4×1BR | 3,200 | Pending | $755,000 | $236 |

| B24 | 4×1BR | 2,720 | For Sale | $775,000 | $285 |

| B76 | 4×2BR | 2,640 | For Sale | $1,015,000 | $384 |

| B56 | 4×2BR | 3,340 | For Sale | $999,999 | $299 |

| D41 | 2+2 Units | 2,600 | For Sale | $876,000 | $337 |

Average PPSF (Active & Pending): $306.59

Projected After-Improved Value (ARV):

3,140 SF × $306.59 = $962,692

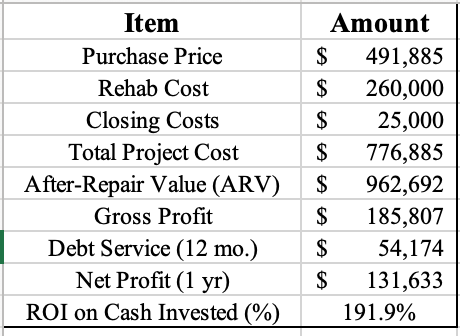

3. Acquisition & Rehab Costs

- Purchase Price (Target Offer): $491,885

- Rehab Budget: $260,000 (conversion to 4×2BR/1BA units)

- Closing Costs / Carrying: $25,000 (est.)

- Total Project Cost: ≈ $776,885

4. Financing Assumptions (Hard Money – Fix & Flip)

- Loan-to-Cost (LTC): 90%

- Total Loan Amount: $692,600 (Purchase $442,600 + Rehab $260,000)

- Cash to Close: $68,593

- Loan Terms: 12.24% Interest-Only, 1 Year (extendable)

- Monthly Payment: $4,515

- Exit Strategy: Sale at ARV $962,692

5. Profitability – Fix & Flip

- Sale Price (ARV): $962,692

- Less Project Cost: $776,885

- Gross Profit (Pre-Financing): $185,807

- Less Debt Service (12 mo.): $54,178

- Net Profit (Pre-Tax): ≈ $131,629

- ROI (Cash Invested): ≈ 192%

6. Alternative Strategies

A. Condominium Conversion

- Upside: Potential for $1.05M+ sell-out if positioned as 4 affordable luxury units.

- Risks: Condo market in 2025 is slower; under-$1M listings face longer DOM and concessions. Recent Condo Sales are mostly 2 bedrooms: 8/12/2025 — 1 BR, 1 BA, 646 s.f. = $260,000 – 1.2 mi || 4/30/2025 — 2 BR, 1 BA, 815 s.f. = $299,900 – .03 mi (across the street) || 5/8/2025 — 2 BR, 2 BA, 784 s.f. = $375,000 – .08 mi.

- Holding Period: 18–24 months financing required.

B. Mixed-Use with Incentives

- Neighborhood Prosperity Fund: $300k–$2.7M grants for commercial/community space.

- Opportunity Zone (Tract 91.02):

- Deferral of gains until 2027.

- 10+ year hold eliminates capital gains tax.

- Potential layering with D.C. HPTF, LRSP, DOES Job Training.

- HubZone / QHTC Tenants: Preferred leasing options for federal contractors & tech firms.

C. Buy & Hold Rental

- Market rents (2BR in NE DC): $2,200–$2,500/month.

- Gross Potential Rent: $8,800–$10,000/month.

- Annualized = $105,600–$120,000.

- NOI (after 30% OPEX): ≈ $73,920–$84,000.

- Cap Rate at ARV: 7.5%–8.7%.

7. Highest & Best Use Recommendation

- Primary Path: Fix & Flip to 4×2BR rentals → Sell stabilized building at ARV.

- Alternative: Condo conversion if financing supports 18–24 months and investor appetite for higher absorption risk exists.

- Long-Term Hold: Attractive as rental with Opportunity Zone + LRSP overlay for subsidy-backed tenants.

FIX AND FLIP ANALYSIS

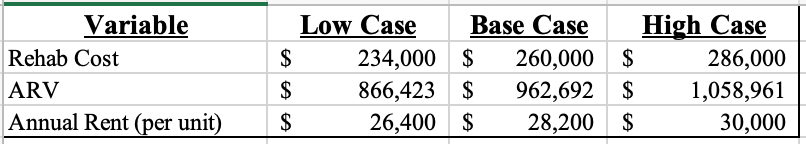

SENSITIVITY ANALYSIS

✅ Conclusion:

This property represents a strong value-add multifamily play with multiple exit strategies. The base fix-and-flip model produces a 192% ROI on cash invested in ~12 months. Risk-adjusted returns improve further if Opportunity Zone incentives and Neighborhood Prosperity Fund grants are leveraged for a mixed-use conversion.